Real estate investors also use the Present Value of Annuity Calculator when buying and selling mortgages. This shows the investor whether the price he is paying is above or below expected value. The present value of a series of payments or receipts will be less than the total of the same payment or receipts.

- Laura started her career in Finance a decade ago and provides strategic financial management consulting.

- If an index of an indexed annuity doesn’t receive enough positive growth, the annuity investor will receive a guaranteed minimum interest return at the bare minimum.

- However, the value of existing, already issued fixed-rate annuities is not impacted by changes in interest rates.

- Discover the scientific investment process Todd developed during his hedge fund days that he still uses to manage his own money today.

- After all, these retirement savings accounts do have the primary purpose of providing income in retirement.

Calculating the Future Value of an Ordinary Annuity

Select the payment/deposit frequency you want the calculator to use for the present value calculations. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the “Data” tab, this line will list the name you gave to that data record. If no data record is selected, or you have no entries stored for this calculator, the line will display “None”. When calculating the present value (PV) of an annuity, one factor to consider is the timing of the payment. If you use our NPV calculator to determine the NPV for each of these projects, you will discover that the NPV of project 1 is equal to $481.55, while the NPV of project 2 is equal to –$29.13.

What is the approximate value of your cash savings and other investments?

Plots are automatically generated to help you visualize the effect that different interest rates, interest periods or future values could have on your result. Investment Management Fees–Similar to management fees paid to portfolio managers of mutual funds and ETFs, variable annuity investments also require fees to pay portfolio managers. When you set all the required parameters, you will immediately see the results summarized in a table. You can also follow the progress of your annuity balance in a dynamic chart and annuity table of the payment schedule.

Present Value Annuity Calculator to Calculate PV of Future Sum or Payment

It means the project’s cash outflows outweigh the cash inflows when adjusted for the time value of money. Essentially, a negative NPV indicates the investment would lose money rather than gain, suggesting it might not be a good choice. IRR is typically used to assess the minimum discount rate at which a company will accept the project. It allows you to establish reasonably quickly whether the project should be considered as an option or discarded because of its low profitability. This is the present value of all of your cash inflows, not taking the initial investment into account.

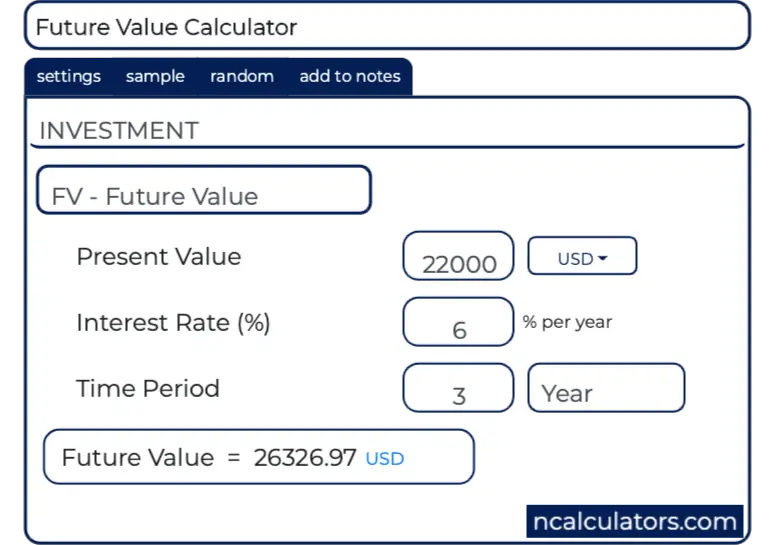

By taking the time to calculate the present value of an annuity, you can decide whether or not investing in an annuity will be in your financial best interest. For example, once the time value of money (TVM) is accounted for, you can see whether it makes sense to allocate your money to a different type of financial asset or to annuities. The future value of an annuity is a difficult equation to master if you are not an accountant. To help you better understand how to calculate future values, an online calculator for investors can help you better understand how annuities are figured.

Rider Charges–An annuity rider is an amendment to an annuity contract that has the effect of either expanding or restricting the policy’s benefits or excluding certain conditions from coverage. A popular example is an income rider; in the case of dramatic drops in the value of mutual fund investments in an annuity, an income rider prevents it from falling below a guaranteed amount. Another common rider is an annual increase rider that increases payment each year by a predetermined percent, usually 1% to 5%, in order to keep pace with inflation.

To understand this definition, you first need to know what is the present value. It means that you need to put $2000 on that account today to have $2200 twelve months from now. By definition, net present value is the difference between the present value of cash inflows and the present value of cash outflows for a given project. In this article, we will help you understand the concept of net present value and provide step-by-step instructions on how to calculate NPV.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

While most annuities will compound periodically, others will compound continuously. You can learn more about compound interest with our compound interest calculator. Other factors, such as your long-term financial goals, when you hope to retire, and your personal level of risk tolerance might also influence whether investing in an annuity is right for you.

Below, we can see what the next five months would cost you, in terms of present value, assuming you kept your money in an account earning 5% interest. To account for payments occurring at the beginning of each period, the ordinary annuity FV formula above requires a slight modification. The present depreciation value of an annuity is the current value of future payments from an annuity, given a specified rate of return, or discount rate. The higher the discount rate, the lower the present value of the annuity. Enter the annual present value discount rate to be used for the present value calculations.