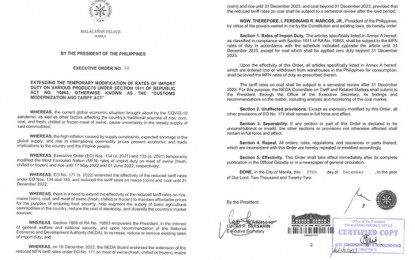

MANILA – President Ferdinand R. Marcos Jr. has signed an executive order (EO) extending the temporary modification of import duty rates on various products such as meat, corn, and rice in order to maintain affordable prices and increase agricultural commodity supply in the country.

Executive Order (EO) No. 10, signed by the President on December 29, 2022, extends the reduced Most Favored Nation (MFN) tariff rates on swine meat (fresh, chilled, or frozen) at 15% (in-quota) and 25% (out-quota); corn at 5% (in-quota) and 15% (out-quota); rice at 35% (in-quota and out-quota); and coal at zero duty until December 31, 2023.

“There is a need to extend the effectiveness of the reduced tariff rates on rice, maize (corn), coal, and swine meat (fresh, chilled, or frozen) to ensure food security, help augment the supply of basic agricultural commodities in the country, reduce the cost of electricity, and diversify the country’s market sources,” the EO stated.

Following the issuance of the EO, all specifically listed articles entered into or withdrawn from warehouses in the Philippines for consumption will be subject to the MFN rates of duty.

After December 31 of this year, coal tariff rates will be subject to a semestral review.

To that end, the National Economic and Development Authority (NEDA) Committee on Tariff and Related Matters shall submit its findings and recommendations on the matter to the President via the Office of the Executive Secretary, including analysis and monitoring of the coal market.

According to the EO, the current global economic situation caused by the Covid-19 pandemic, as well as other factors affecting the country’s traditional sources of rice, corn, coal, and fresh, chilled, or frozen swine meat, is causing uncertainty in the consistent supply of said commodities.

It also mentioned how the country’s and the Filipino people’s economic and trade implications are being impacted by high inflation caused by supply constraints, expected shortages in global supply, and rise in international commodity prices.

EO Nos. 134 and 135 modified the MFN rates of import duty on swine meat (fresh chilled or frozen) until May 17, 2022, and rice until June 1, 2022, respectively.

EO No. 171, on the other hand, extended the duration of the effectivity of the reduced tariff rates under EO Nos. 134 and 135, and reduced the tariff rates on maize and coal until December 31, 2022.

Section 1608 of Republic Act 10863, also known as the Customs Modernization and Tariff Act, empowers the President to raise, lower, or eliminate existing import duty rates “in the interest of general welfare and national security.”

Source: PNA